Boosted.ai, the leading distributed machine learning platform for global investment professionals, today announced the closing of a $35 million USD Series B financing round, led by Ten Coves Capital and Spark Capital. Portage Ventures, Royal Bank of Canada (RBC) and HarbourVest Partners also participated in the round. Inclusive of seed capital, Boosted.ai’s total funding now stands at $46 million USD.

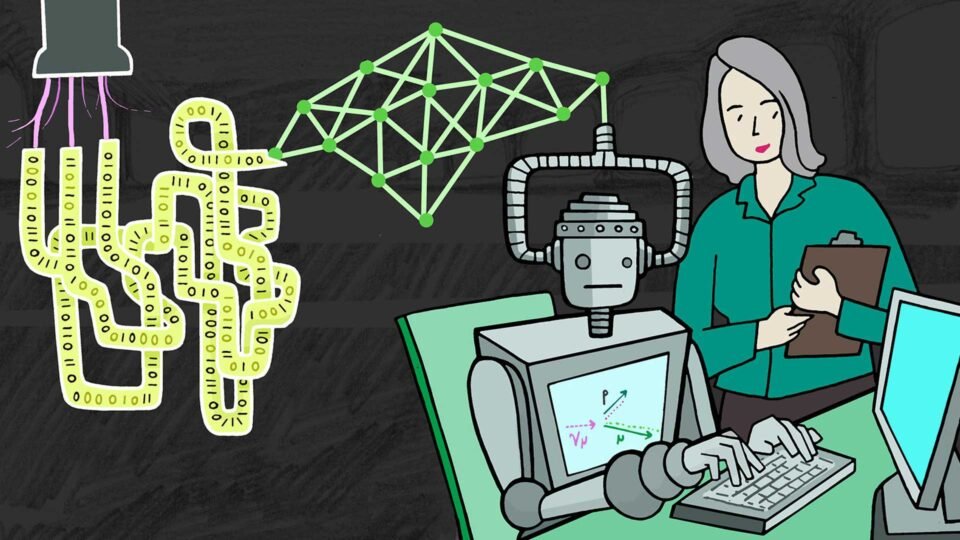

The funding will be used to scale Boosted Insights, the company’s web-based platform that brings explainable machine learning tools to investment managers. By using Boosted Insights, portfolio management teams can augment their existing investment processes, source new ideas and manage risks through AI without any prior coding knowledge.

Co-founded in 2017 by Joshua Pantony, Jon Dorando and Nicholas Abe, Boosted.ai currently has more than 40 active clients across a full spectrum of global asset managers, including hedge funds and ETF providers. RBC, an investor in the round, is a current client of Boosted.ai. In terms of size, Boosted.ai clients range from family offices with roughly $10 million USD in assets under management (AUM) to asset managers with over $1 trillion USD in AUM. In 2021, Boosted.ai more than doubled the number of firms using its platform and increased revenue by 250%, and the company plans to double its current employee count.

In conjunction with the funding round, Dan Kittredge from Ten Coves Capital and Santo Politi from Spark Capital have joined Boosted.ai’s Board of Directors.

Joshua Pantony, CEO of Boosted.ai, said: “The world’s asset managers have never been as focused as they are today on bringing AI to their investment processes, but the number of firms who have successfully developed such capabilities in-house remains remarkably low. For virtually all other managers, a lack of time, money and talent will prevent machine learning from becoming a core competency or true differentiator. We have spent the past five years building Boosted Insights to solve for that gap in a way that is understandable and explainable to all styles of portfolio managers and allocators.”

Nicholas Abe, COO of Boosted.ai, said: “We believe that the future of investing is quantamental: human plus machine. Asset managers generally have a harder time adding the machine element to that equation. By taking care of that for them, we are democratizing access to machine learning and allowing investors to focus on the human talent and domain expertise that truly differentiate their businesses.”

Dan Kittredge, Managing Partner at Ten Coves Capital, said: “The investment management industry is almost unanimously expecting technology, data and digital capabilities to become core differentiators over the next five years. Boosted.ai is perfectly positioned to scale its platform and bring explainable machine learning to an even wider variety of asset managers, regardless of their location, investment style or size.”

Santo Politi, General Partner at Spark Capital, said: “It is inherently difficult for financial firms to build a central repository of machine learning knowledge, which is one of the main reasons why only a handful of managers can claim to power their investment processes through AI. Boosted.ai is becoming a necessary nucleus for machine learning expertise within asset management.”

Adam Felesky, CEO of Portage Ventures, said: “We are excited to expand our investment in Boosted.ai as they bring their explainable financial algorithms to asset managers across regions. Whether you are an ETF provider based in the United States, a traditional asset manager based in China, or a family office based in Europe, Boosted.ai has proven that the combination of machine learning and human expertise can accomplish more than either can alone.”

For more such updates and perspectives around Digital Innovation, IoT, Data Infrastructure, AI & Cybersecurity, go to AI-Techpark.com.