KORE Group Holdings, Inc. (NYSE: KORE, KORE WS) (“KORE” or the “Company”), a global leader in Internet of Things (IoT) solutions and worldwide IoT Connectivity-as-a-Service (“CaaS”), today reported financial and operational results for the quarter ended June 30, 2022.

“In the second quarter, year-over-year, KORE again generated strong growth. Total revenue increased 16%, led by 47% growth in IoT Solutions, and the number of connected devices on the KORE platform increased to 15.2 million compared to 13.2 million,” said Romil Bahl, President and CEO of KORE. “I am proud of the KORE team for their hard work in delivering another quarter of strong results. As we have consistently communicated since going public three quarters ago, we expect the second half of 2022 to be down versus the first half due to the LTE transition program at our largest customer ending, as well as the ongoing 2G and 3G sunsets in the U.S. impacting our business. However, based on our strong first half, and despite an increasing headwind from foreign exchange, primarily against the euro, we are maintaining our guidance for the year.”

KORE: Company Highlights

- Second-quarter revenue of $70.4 million increased 16% year-over-year, driven by 47% growth in IoT Solutions and a 3% increase in IoT Connectivity.

- DBNER1 increased to 114% in second quarter of 2022, compared to 113% in second quarter of 2021.

- The Company is maintaining its fiscal 2022 revenue and adjusted EBITDA, a non-GAAP metric2, guidance at $260-265 million and $63-64 million, respectively.

- KORE generated $14.7 million in cash flow from operations in the second quarter.

- On June 27, 2022, KORE was added as a member of the broad-market Russell 3000® Index.

Financial Performance for Second Quarter 2022, Compared to the Same Period of 2021:

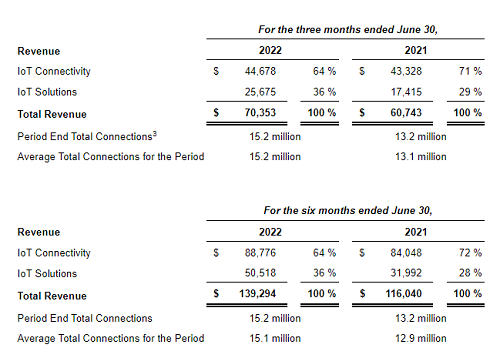

- Total revenue increased 16% to $70.4 million, compared to $60.7 million.

- IoT Solutions revenue increased 47% to $25.7 million, compared to $17.4 million. Revenue growth in the second quarter was primarily the result of the acquisition of Business Mobility Partners Inc. and Simon IoT LLC (the “BMP-Simon Acquisition”).

- IoT Connectivity revenue increased 3% to $44.7 million, compared to $43.3 million.

- Net loss increased to $11.1 million, or $0.15 per share, compared to $6.9 million, or $0.46 per share.

- Adjusted EBITDA increased 8% to $15.9 million, compared to $14.7 million.

Financial Performance for Six Months Ending June 30, 2022, Compared to the Same Period of 2021:

- Total revenue increased 20% to $139.3 million, compared to $116.0 million.

- IoT Solutions revenue increased 58% to $50.5 million, compared to $32.0 million. Revenue growth in the six-month period was primarily the result of the BMP-Simon Acquisition.

- IoT Connectivity revenue increased 6% to $88.8 million, compared to $84.0 million.

- Net loss increased to $22.0 million, or $0.29 per share, compared to $8.0 million, or $0.72 per share.

- Adjusted EBITDA increased 1% to $31.5 million, compared to $31.2 million.

The table below summarizes our revenue and certain key metrics (amounts in thousands USD except for Total Connections):

Second Quarter 2022 Key Metrics and Business Successes

- KORE grew total connected devices to approximately 15.2 million Total Connections, a year-over-year increase of 15%.

- DBNER was 114% for the second quarter of 2022, compared to 113% in the second quarter 2021.

- KORE Fleet launched Pro AI™, the first “plug-and-play” camera, to the integrated in-vehicle video platform. Pro AI has been well received by customers and KORE expects this innovative product to drive sales of its video telematics solution.

- KORE was recently named a 2022 Global Competitive Strategy Leader in the Internet of Things Professional Services Industry by research and consulting firm Frost & Sullivan.

- Successfully completed the Pilot Phase with three customers for KORE’s Connected Health Telemetry Solution (CHTS), which was recently awarded the IoT Evolution Product of the Year by IoT Evolution World.

2022 Financial Outlook

For the twelve months ending December 31, 2022, the Company continues to expect:

- Revenue of $260 million to $265 million.

- Adjusted EBITDA of $63 million to $64 million, representing a margin of approximately 24%.

“While the remainder of 2022 will be impacted by the transitory factors we have previously communicated, I am excited that KORE’s growth prospects will become more evident next year. Following the completion of the U.S. 2G/3G network sunsets this year, and against a backdrop of stabilizing ARPU, our IoT Connectivity business is poised to grow in a more exciting fashion in 2023 and beyond. And with our largest customer’s LTE transition project complete, our IoT Solutions business will now reset to a normalized base from which it too can grow,” Bahl said.

Continued Bahl, “with our recurring revenue and industry-leading IP, we are attacking a significant market opportunity. It is worth noting that KORE has continued to grow in the face of a global pandemic, network transitions, supply chain shortages, and global economic uncertainty. We have proven the quality and resilience of our business model and our ability to grow in a difficult environment – and I am confident we have a tremendous opportunity for shareholder value creation in front of us.”

Visit AITechPark for cutting-edge Tech Trends around AI, ML, Cybersecurity, along with AITech News, and timely updates from industry professionals!