- Revenue of $37.6 million for the second quarter ended June 30, 2022

- Gross margin of 25% for the second quarter ended June 30, 2022

- Analytics segment adjusted gross margin of 39% for the second quarter of 2022

- Expanded enterprise SaaS contracts in key commercial market

- Ending backlog of $325 million

- Revised 2022 financial outlook

BigBear.ai Holdings, Inc. (NYSE: BBAI) (“BigBear.ai” or the “Company”), a leader in AI-powered analytics and cyber engineering solutions, today announced financial results for the second quarter of 2022.

BigBear.ai CEO Dr. Reggie Brothers said, “We continue to focus on evolving our business to become a more scalable and profitable technology-first company. While the second quarter presented challenges to our 2022 performance and slowed the pace of our transformation, we remain confident in our ability to capture larger, higher-margin projects with both federal and commercial customers to drive long-term growth.”

“Our ProModel acquisition this quarter significantly expanded our offerings with industry-leading modeling, simulation, and planning applications used by hundreds of global customers. In healthcare, hospitals are leveraging our software to predict patient loads, optimize patient care, and improve financial performance. We are building a strong pipeline, and in the second quarter we signed an agreement with one of the largest health systems in the Eastern U.S. We are seeing similar demand in the optimization of shipyard operations, a critical part of the current challenges in the global supply chain. Although commercial sales cycles are moving more slowly due to economic uncertainty, we are pleased with the progress of our integration and initial bookings, and we expect to see a positive impact on revenue in the second half of 2022 and a more significant impact in 2023.”

“For our government customers, their focus on addressing immediate needs in Ukraine has slowed the pipeline and pace of contract awards, pushing revenue further to the right. We continue to expect the geopolitical climate to drive adoption of our offerings over the long term, as it has heightened the need for advanced AI tools that provide enhanced intelligence and full spectrum cyber operations – areas where we have unmatched capabilities.”

Dr. Brothers added, “While we still have a healthy backlog and growing pipeline, the timing of new deals has been difficult to predict given current market conditions. As such, we are taking a more conservative approach in estimating certain opportunities in our forecast and backlog. This change, combined with delays in federal contract awards and longer sales cycles, has driven us to revise our outlook for 2022.”

“Looking ahead, our investments in Analytics and our commercial expansion will help us transition our business to drive revenue and capture more predictable, higher margin, SaaS-based projects. However, in light of our second quarter performance and revised guidance, we are taking stringent steps to reduce our expenses and cash usage, and to significantly increase our operational efficiency going forward.”

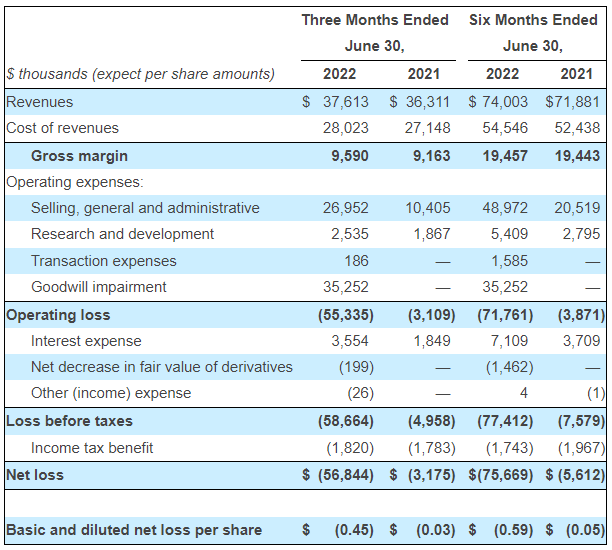

Financial Highlights

- Revenue of $37.6 million, compared to $36.3 million for the second quarter of 2021

- Analytics revenue increased $2.9 million, or 18%, as compared to the same period in 2021, primarily driven by continued expansion of key programs

- Gross margin of 25%, compared to 25% for the second quarter of 2021

- Segment adjusted gross margin of 39% for the Analytics segment compared to 46% for the second quarter of 2021. The decrease reflects investments in prototype contracts that are expected to yield higher margins upon the award of subsequent production contracts

- Segment adjusted gross margin of 24% for the Cyber & Engineering segment, compared to 22% for the second quarter of 2021

- Net loss of $(56.8) million, compared to $(3.2) million for the second quarter of 2021, primarily driven by a non-cash goodwill impairment charge of $35.3 million in our Cyber & Engineering segment. The increase in the net loss was also a result of higher public company expenses as well as infrastructure and integration costs

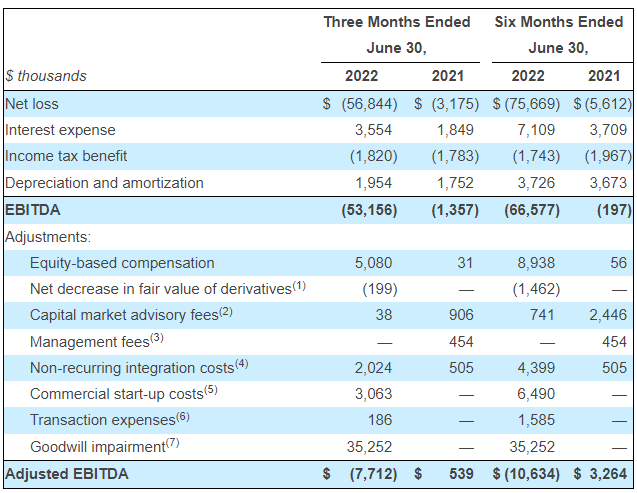

- Non-GAAP adjusted EBITDA* of $(7.7) million, compared to $0.5 million for the second quarter of 2021, primarily driven by increased investment to support future growth, operate successfully as a public company, and enhance or develop new capabilities through increased investment in research and development

- Ending backlog of $325 million as a result of a change to our methodology in measuring backlog. Under the revised methodology, backlog does not include Anticipated Follow-on Awards, which were historically estimated when a customer notified us that a program we currently support would be continuing under a new contract. Additionally, we have reassessed our unpriced, unexercised backlog, and while we have this work under contract with not-to-exceed limits, we have updated our estimates on what we believe will actually be funded in the future on these contracts.

Julie Peffer, who joined BigBear.ai in June as the Company’s CFO, said, “In the second quarter, our top line revenue was impacted by the focus on the war in Ukraine, which delayed the timing on some anticipated contract awards in our near-term pipeline. Along with these revenue delays, our Adjusted EBITDA was impacted by strategic investments in certain lower margin prototype contracts. While this prototype work frequently requires significant up-front investment, it has the potential to lead to large multi-year contracts with considerably higher margins. We expect to see conversion soon and continuing through 2023 based on initial customer responses.”

“Additionally, our second quarter margins and Adjusted EBITDA were impacted by a higher level of operating expenses linked to public company governance, transaction and integration costs related to the ProModel acquisition, and our go-to-market strategy in our commercial business. We are in the process of conducting a rigorous and disciplined assessment of our cost structure, and going forward, we expect to significantly reduce our cash burn through aggressive cost savings initiatives, streamline operations, and fully integrate as one business. We believe added rigor around expense management, coupled with our healthy backlog, strong customer relationships, and expanding addressable market, position BigBear.ai for long-term, profitable growth,” added Peffer.

Financial Outlook

The following information and other sections of this release contain forward-looking statements, which are based on the Company’s current expectations. Actual results may differ materially from those projected. It is the Company’s practice not to incorporate adjustments into its financial outlook for proposed acquisitions, divestitures, changes in law, or new accounting standards until such items have been consummated, enacted, or adopted. For additional factors that may impact the Company’s actual results, refer to the “Forward-Looking Statements” section in this release.

The Company now projects:

- Revenue of approximately between $150 million to $170 million for the year-ended December 31, 2022

- Single digit negative Adjusted EBITDA*, in millions, for the second half of 2022

Summary of Results for the Second Quarter and Year to Date Periods

EndedJune 30, 2022 and June 30, 2021(Unaudited)

EBITDA* and Adjusted EBITDA* for the Second Quarter and Year to Date Periods Ended

June 30, 2022 and June 30, 2021

(Unaudited)

(1) The decrease in fair value of derivatives primarily relates to the changes in the fair value of certain Forward Share Purchase Agreements (FPAs) that were entered into prior to the closing of the Business Combination and were fully settled during the first quarter of 2022, as well as changes in the fair value of private warrants.

(2) The Company incurred capital market and advisory fees related to advisors assisting with the Business Combination.

(3) Management and other related consulting fees paid to AE Partners. These fees ceased subsequent to the Business Combination.

(4) Non-recurring internal integration costs related to the Business Combination.

(5) Commercial start-up costs includes certain non-recurring expenses associated with tailoring the Company’s software products for commercial customers and use cases.

(6) Transaction expenses related to the acquisition of ProModel Corporation, which closed on April 7, 2022.

(7) During the second quarter of 2022, the Company recognized a non-cash goodwill impairment charge related to its Cyber & Engineering business segment.

Consolidated Balance Sheets as of

June 30, 2022 and December 31, 2021

(Unaudited)

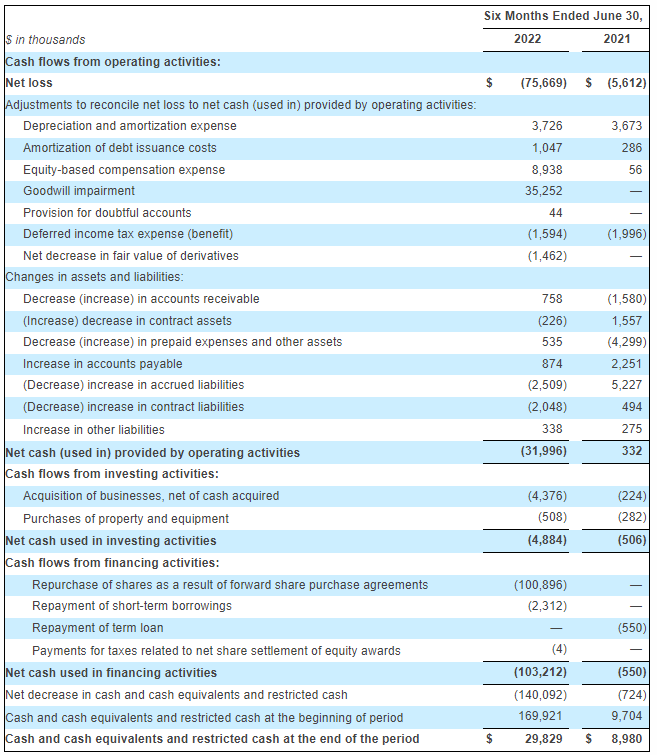

Consolidated Statements of Cash Flows for the Six Months Ended

June 30, 2022 and June 30, 2021 (Unaudited)

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding BigBear.ai’s industry, future events, and other statements that are not historical facts. These statements are based on various assumptions, whether or not identified herein, and on the current expectations of BigBear.ai’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by you or any other investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond our control. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; risks related to the uncertainty of the projected financial information (including on a segment reporting basis); risks related to delays caused by factors outside of our control, including changes in fiscal or contracting policies or decreases in available government funding; changes in government programs or applicable requirements; budgetary constraints, including automatic reductions as a result of “sequestration” or similar measures and constraints imposed by any lapses in appropriations for the federal government or certain of its departments and agencies; influence by, or competition from, third parties with respect to pending, new, or existing contracts with government customers; potential delays or changes in the government appropriations or procurement processes, including as a result of events such as war, incidents of terrorism, natural disasters, and public health concerns or epidemics, such as the recent coronavirus outbreak; and increased or unexpected costs or unanticipated delays caused by other factors outside of our control, such as performance failures of our subcontractors; risks related to the rollout of the business and the timing of expected business milestones; the effects of competition on our future business; our ability to issue equity or equity-linked securities in the future, and those factors discussed in the Company’s reports and other documents filed with the SEC, including under the heading “Risk Factors.” If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that BigBear.ai presently does not know or that BigBear.ai currently believes are immaterial which could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect BigBear.ai’s expectations, plans or forecasts of future events and views as of the date of this release. BigBear.ai anticipates that subsequent events and developments will cause BigBear.ai’s assessments to change. However, while BigBear.ai may elect to update these forward-looking statements at some point in the future, BigBear.ai specifically disclaims any obligation to do so. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Non-GAAP Financial Measures

The financial information and data contained in this press release is unaudited. Some of the financial information and data contained in this press release, such as Adjusted EBITDA, have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). To supplement our unaudited condensed consolidated financial statements, which are prepared and presented in accordance with GAAP in our press release, we also report certain non-GAAP financial measures. A “non-GAAP financial measure” refers to a numerical measure of a company’s historical or future financial performance, financial position, or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP in such company’s financial statements.

The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP and should not be considered measures of BigBear.ai’s liquidity. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, many of the adjustments to our GAAP financial measures reflect the exclusion of certain items, as defined in our non-GAAP definitions below, which are recurring and will be reflected in our financial results for the foreseeable future. In addition, these measures may be different from non-GAAP financial measures used by other companies, even where similarly titled, limiting their usefulness for comparison purposes and therefore should not be used to compare BigBear.ai’s performance to that of other companies. We endeavor to compensate for the limitation of the non-GAAP financial measures presented by also providing the most directly comparable GAAP measures and descriptions of the reconciling items and adjustments to derive the non-GAAP financial measures.

We believe these non-GAAP financial measures provide investors and analysts with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key measures used by management to operate and analyze our business over different periods of time

Adjusted EBITDA is defined as of any date of calculation, the consolidated pro forma earnings of the Company and its subsidiaries, before finance income and finance cost (including bank charges), tax, depreciation and amortization calculated from the audited consolidated financial statements of such party and its subsidiaries (prepared in accordance with GAAP), transaction fees and other non-recurring costs. Similar excluded expenses may be incurred in future periods when calculating these measures. BigBear.ai believes these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. BigBear.ai believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends and in comparing BigBear.ai’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors.

Non-GAAP financial performance measures are used to supplement the financial information presented on a GAAP basis. This non-GAAP financial measure should not be considered in isolation or as a substitute for the relevant GAAP measures and should be read in conjunction with information presented on a GAAP basis. Because not all companies use identical calculations, our presentation of non-GAAP measures may not be comparable to other similarly titled measures of other companies.

Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which expense and income items are excluded or included in determining these non-GAAP financial measures.

Management uses EBITDA and adjusted EBITDA as a non-GAAP performance measure which is defined in the accompanying tables and is reconciled to earnings (loss) before taxes.

We present reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measure in the tables above.

Conference Call / Webcast Information

BigBear.ai will host its earnings results conference call and audio webcast (listen-only mode) on Tuesday, August 9, 2022 at 5:00 p.m. ET. The earnings conference call can be accessed by calling 877-485-3107 (toll-free) or 201-689-8427 (toll). The listen-only audio webcast of the call will be available on the BigBear.ai Investor Relations website: https://ir.bigbear.ai. For those who are unable to listen to the live event, a replay will be available for two weeks following the event by dialing 877-660-6853 (toll-free) or 201-612-7415 (toll) and entering the access code 13730749. To access the webcast replay, visit https://ir.bigbear.ai.

Visit AITechPark for cutting-edge Tech Trends around AI, ML, Cybersecurity, along with AITech News, and timely updates from industry professionals!