The “Edge Computing Market – Global Forecast to 2026″ report has been added to ResearchAndMarkets.com’s offering.

The edge computing market size is expected to grow from USD 36.5 billion in 2021 to USD 87.3 billion by 2026, at a CAGR of 19.0%

The growing adoption of IoT across industries, exponentially increasing data volumes and network traffic and rising demand for low-latency processing and real-time, automated decision-making solutions are a few factors driving the growth of edge computing.

Adoption of edge computing software can dramatically improve performance by achieving the next level of security, such as edge-based threat detection, data minimization, and decentralized infrastructure.

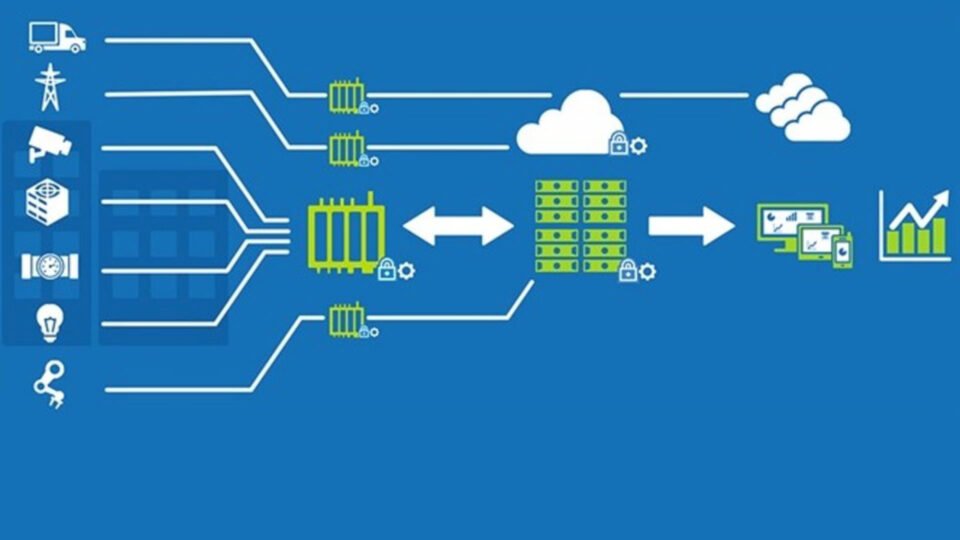

The edge computing software includes edge computing platforms and operating systems that enhance the computing capabilities of edge devices and data centers within the network infrastructure. These platforms control hardware functions, support the collection of data from assets, assist in condition monitoring of remotely located assets, and help establish a network connection between edge devices and computing resources.

The edge computing platform also helps debug and test data flows on remote data. The edge computing software can dramatically improve performance by achieving the next level of security, such as edge-based threat detection, data minimization, and decentralized infrastructure.

Industrial IoT combines real-time processing, hardware optimization capabilities, and ubiquitous connectivity for IoT systems to maximize the efficiency of machines and the throughput of the entire process.

Edge computing is one of the core components of the industrial internet of things. It plays an important role in accelerating the journey towards industry 4.0 adoption. For a device deployed in an IIoT environment, an edge computing platform must be integrated with different resources from the data center to the cloud.

IIoT represents a wide variety of IoT applications in the industrial sector, including smart robotics, remote diagnosis, asset optimization, connected manufacturing and product integration, and smart construction. Industrial IoT combines real-time processing, hardware optimization capabilities, and ubiquitous connectivity for IoT systems to maximize the efficiency of machines and the throughput of the entire process.

Smart robotics, remote diagnosis, asset optimization, connected product integration, and smart construction applications will drive edge computing adoption in various industries as it combines real-time processing, hardware optimization capabilities, and ubiquitous connectivity for IoT systems to maximize the efficiency of machines and the throughput of the entire process. By infusing edge computing in IIoT processes, companies could achieve improved network communication and cooperative coordination with the cloud-connected to the system.

Thus, the proliferation of IIoT devices makes the introduction of edge computing functionalities easier to be deployed at end-user locations as these devices are equipped with processing units that can support edge technology.

Small and Medium Enterprises are choosing edge computing due to ease of operations and enhanced scalability.

The intensely competitive market scenario has encouraged SMEs to invest in edge computing solutions to reach their desired target audience. Strategizing content marketing initiatives is difficult for startups that do not have an established customer base. Small businesses in the UK are falling behind when it comes to the adoption of new technology.

According to a survey by VOLTA data center, 38% of small businesses are utilizing the edge computing technology compared to large enterprises where it is 60%. Various leading companies, such as AWS and TIBCO, have introduced lightweight edge computing solutions to help automate the analysis of data with rapid implementation benefits at a lower infrastructure cost.

With the increasing awareness about the edge computing benefits, the growth of the edge computing market could be high among SMEs in the future.

With the increasing number of IoT sensors across factory floors, manufacturers have started achieving industrial automation and manufacturing efficiency.

IoT-enabled manufacturing requires the building and maintenance of high-capacity data centers for storage, processing, and analysis of voluminous data generated by sensors. For overcoming such issues, organizations are rapidly implementing edge computing with smart manufacturing. With localized processing, edge computing also offers cost-effective ways of achieving remote monitoring and strengthening disaster recovery strategies.

Moreover, edge computing enables data gathering and analytics closer to the sensing and acting points, which help companies reduce unforeseen downtime issues and improve production efficiency. In intermittent or low connectivity, edge computing also ensures low latency and immediacy of analysis.

North America to dominate the edge computing market in 2021.

North America is one of the most technologically advanced regions in the world. It comprises the US and Canada and accounts for the largest share of the global edge computing market due to the early adoption of the by the US markets.

The increased pace of digitalization in SMEs across verticals is boosting the adoption of edge computing. The region has a presence of large edge computing vendors and customers, which is also driving the market growth in the region.

The increasing number of alliances and partnerships among edge computing and other technology providers for continuous technological innovations and advancements in edge computing have further added to the growth of the global edge computing market in North America.

For example, SAS, an edge analytics solution provider, and HPE, an edge computing infrastructure provider, collaborated to launch comprehensive IoT analytics solutions. Similarly, Dell Technologies, an edge computing infrastructure provider, and AT&T, a telecommunications company, also collaborated to develop an open-source edge computing and 5G software infrastructure. IoT is trending in North America; with more IoT devices getting connected, the region’s market has seen broader adoption of edge computing solutions across all verticals.

The presence of connectivity networks will act as a driving factor to facilitate the adoption of edge computing. The average number of digital devices available to the citizen is increasing exponentially. People are better connected with enhanced access to brand and content. Gaming and eCommerce markets are booming in this region. This would widen the opportunity of edge computing.

The report profiles the following key vendors:

- Cisco (US)

- HPE (US)

- Huawei (China)

- IBM (US)

- Dell Technologies (US)

- Nokia (Finland)

- Litmus Automation (US)

- AWS (US)

- Foghorn (US)

- Microsoft (US)

- VMWare (US)

- SixSq (Switzerland)

- EdgeIQ (US)

- Saguna (Isreal)

- Vapour IO (US)

Premium Insights

- Rising Use of BYOD in Modern Business and Technological Evolution to Drive the Market Growth

- Hardware Segment to Account for the Largest Market Size by 2026

- Smart Cities Segment to Account for the Largest Market Size by 2026

- Large Enterprises to Account for a Larger Market Size by 2026

- Manufacturing Segment to Account for the Largest Market Size by 2026

- Asia-Pacific to Emerge as the Best Market for Investments in the Next Five Years

Market Dynamics

Drivers

- Growing Adoption of IoT Across Industries

- Exponentially Increasing Data Volume and Network Traffic

- Rising Demand for Low-Latency Processing and Real-Time, Automated Decision-Making Solutions

Restraints

- Initial Capex for Infrastructure

Opportunities

- Emergence of Autonomous Vehicles and Connected Car Infrastructure

- Advent of 5G Network to Deliver Instant Communication Experiences

Challenges

- Complexity in Integrating with Existing Cloud Architecture

- Cyberattacks and Limited Authenticated Capabilities at the Edge

Case Study Analysis

- Case Study 1: Unprecedented Visibility into Pharmaceutical Supply Chains

- Case Study 2: Real-Time Quality Inspection for Smart Factory

- Case Study: 3 Optimized Data Migration

- Case Study: 4 Predictive Equipment Maintenance to Improve Service Efficiency and Profitability

- Case Study: 5 Quick Processing in Geographically Dispersed Data Centers

Patent Analysis

- Number of Patents Published

- Top Five Patent Owners (Global)

- Top Ten Patent Owners

- Patents Granted to Vendors in the Edge Computing Market

Technological Analysis

- Ai and Machine Learning

- 5G

- Internet of Things

- Augmented and Virtual Reality

Companies Mentioned

- Adlink

- AWS

- Axellio

- Belden

- Capgemini

- Cisco

- Clearblade

- Dell Technologies

- Digi International

- Edgeconnex

- Edgeintelligence

- Edgeiq

- Edgeworx

- Foghorn

- GE Digital

- Hewlett Packard Enterprise

- Huawei

- IBM

- Juniper Networks

- Litmus Automation

- Microsoft

- Moxa

- Nokia

- Saguna Networks

- Sierra Wireless

- Sixsq

- Vapour IO

- Vmware

For more such updates and perspectives around Digital Innovation, IoT, Data Infrastructure, AI & Cybersecurity, go to AI-Techpark.com.