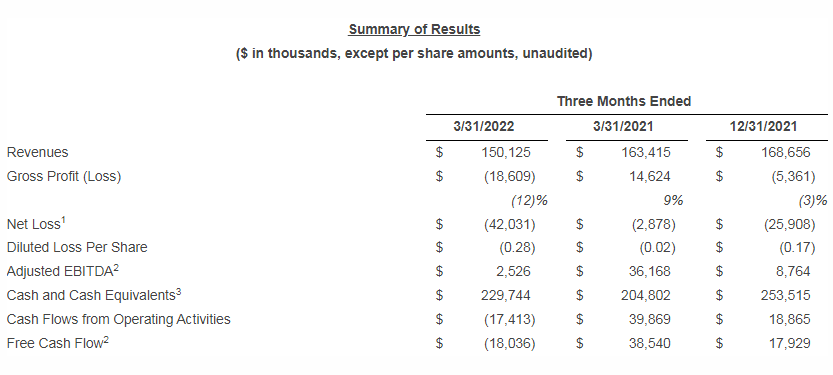

Helix Energy Solutions Group, Inc. (“Helix”) (NYSE: HLX) reported a net loss1 of $42.0 million, or $(0.28) per diluted share, for the first quarter 2022 compared to $25.9 million, or $(0.17) per diluted share, for the fourth quarter 2021 and $2.9 million, or $(0.02) per diluted share, for the first quarter 2021.

Helix reported adjusted EBITDA2 of $2.5 million for the first quarter 2022 compared to $8.8 million for the fourth quarter 2021 and $36.2 million for the first quarter 2021. The table below summarizes our results of operations:

Owen Kratz, President and Chief Executive Officer of Helix, stated, “As previously disclosed, 2022 will be a transition year for Helix and has started out as we expected, with several vessels undergoing regulatory inspections, a slow return for the North Sea market and several vessels performing short-term work at reduced rates. However, we feel the long-term fundamentals remain strong for Helix, and our improved outlook for the second half of 2022 and into 2023 is beginning to take shape. We have contracted several long-term awards, including at least two years with Trident in Brazil, a multi-year award with Shell in the U.S. as well as other projects scheduled for 2023. We are managing the improving market with extensions of our charters on the Siem Helix vessels, and we added two robotics support vessels under term charters to secure the resources required for our North Sea trenching and U.S. robotics operations.”

| 1 | Net loss attributable to common shareholders |

| 2 | Adjusted EBITDA and Free Cash Flow are non-GAAP measures; see reconciliations below |

| 3 | Excludes restricted cash of $72.9 million, $65.6 million and $73.6 million as of 3/31/22, 3/31/21 and 12/31/21, respectively |

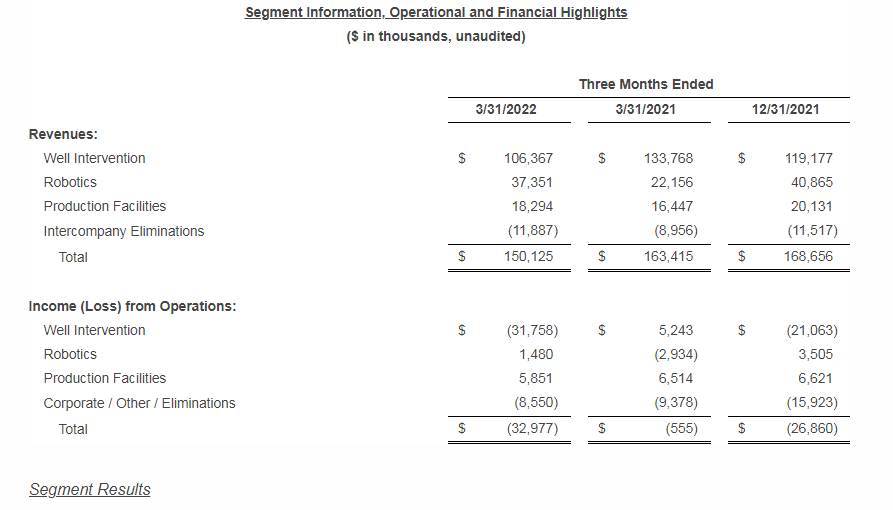

Well Intervention

Well Intervention revenues decreased $12.8 million, or 11%, in the first quarter 2022 compared to the prior quarter. The decrease was primarily due to lower revenues in Brazil and West Africa. Revenues in Brazil declined due to lower utilization and rates on the Siem Helix 2, which had 23 days off contract during its five-year regulatory inspections and operated at lower rates under its extended contract during the first quarter 2022. Revenues in West Africa declined due to lower rates compared to the prior quarter. Overall Well Intervention vessel utilization increased to 67% during the first quarter 2022 compared to 56% in the prior quarter, primarily due to the deployment of the Siem Helix 1 on a low revenue accommodations project throughout the first quarter 2022 after having been idle during the prior quarter. Well Intervention net loss from operations increased $10.7 million during the first quarter 2022 compared to the prior quarter primarily due to lower revenues.

Well Intervention revenues decreased $27.4 million, or 20%, in the first quarter 2022 compared to the first quarter 2021. The decrease was primarily due to lower rates and utilization in Brazil, offset in part by higher utilization in West Africa during the first quarter 2022. Our Brazil operations during the first quarter 2021 were on legacy contract rates with Petrobras with full utilization, whereas during the first quarter 2022 the Siem Helix 2 operated at lower rates under its extended contract with Petrobras and incurred 23 days off contract during its five-year regulatory inspection, and the Siem Helix 1 was operating on an accommodations project throughout the first quarter 2022 at lower rates. The Q7000 was fully utilized during the first quarter 2022 compared to only 67% utilized during the first quarter 2021. Gulf of Mexico revenues were nominally changed from the prior year, with higher-margin work on the Q5000’s legacy BP contract during the first quarter 2021 replaced by higher cost integrated projects during the first quarter 2022. Overall Well Intervention vessel utilization decreased to 67% during the first quarter 2022 compared to 70% during the first quarter 2021. Well Intervention incurred a net loss from operations of $31.8 million in the first quarter 2022 compared to operating income of $5.2 million in the first quarter 2021 due to lower revenues as well as lower margins in the Gulf of Mexico due to higher integrated project costs during the first quarter 2022.

Robotics

Robotics revenues decreased $3.5 million, or 9%, in the first quarter 2022 compared to the prior quarter. The decrease in revenues was due to seasonally lower vessel, ROV and trencher activities during the first quarter 2022. Chartered vessel days decreased to 323 days during the first quarter 2022 compared to 419 total vessel days during the prior quarter, and vessel utilization decreased to 90% in the first quarter 2022 compared to 99% during the prior quarter. Vessel days during the first quarter 2022 included 136 spot vessel days performing seabed clearance work in the North Sea, compared to 237 spot vessel days, including 197 spot vessel days performing seabed clearance work in the North Sea and 40 spot vessel days completing the ROV support work for a telecom project offshore Guyana, during the prior quarter. ROV and trencher utilization decreased to 35% in the first quarter 2022 from 38% in the prior quarter, and trenching days decreased to 66 days during the first quarter 2022 compared to 90 days during the prior quarter. Robotics operating income decreased $2.0 million during the first quarter 2022 compared to the prior quarter due to lower revenues.

Robotics revenues increased $15.2 million, or 69%, during the first quarter 2022 compared to the first quarter 2021. The increase in revenues was due primarily to higher vessel and ROV activities year over year. Chartered vessel days increased to 323 total vessel days during the first quarter 2022 compared to 165 total vessel days during the first quarter 2021, although vessel utilization was flat at 90% in both the first quarters 2022 and 2021. Vessel days during the first quarter 2022 included 136 spot vessel days performing seabed clearance work in the North Sea, compared to three spot vessel days during the first quarter 2021. ROV and trencher utilization increased to 35% in the first quarter 2022 from 24% in the first quarter 2021, although trenching days decreased to 66 days during the first quarter 2022 compared to 72 days during the first quarter 2021. Robotics generated operating income of $1.5 million during the first quarter 2022 compared to operating losses of $2.9 million during the first quarter 2021, an improvement of $4.4 million, due to higher revenues year over year.

Production Facilities

Production Facilities revenues decreased $1.8 million, or 9%, in the first quarter 2022 compared to the prior quarter primarily due to a decline in oil and gas production volumes. Production Facilities revenues increased $1.8 million, or 11%, compared to the first quarter 2021 primarily due to higher oil and gas prices.

Selling, General and Administrative and Other

Selling, General and Administrative

Selling, general and administrative expenses were $14.4 million, or 9.6% of revenue, in the first quarter 2022 compared to $21.5 million, or 12.7% of revenue, in the prior quarter. The decrease was primarily due to lower employee incentive compensation costs.

Other Income and Expenses

Other expense, net was $3.9 million in the first quarter 2022 compared to $0.1 million in the fourth quarter 2021. Other expense, net in the first quarter 2022 included unrealized foreign currency losses related to the British pound, which weakened approximately 3% during the first quarter 2022.

Cash Flows

Operating cash flows were $(17.4) million during the first quarter 2022 compared to $18.9 million during the prior quarter and $39.9 million during the first quarter 2021. The decrease in operating cash flows quarter over quarter and year over year was primarily due to lower earnings, higher regulatory recertification costs for our vessels and systems and negative changes in net working capital during the first quarter 2022. Regulatory recertification costs for our vessels and systems, which are included in operating cash flows, were $10.3 million during the first quarter 2022 compared to $2.5 million during the prior quarter and $1.8 million during the first quarter 2021.

Capital expenditures totaled $0.6 million during the first quarter 2022 compared to $0.9 million during the prior quarter and $1.3 million during the first quarter 2021.

Free Cash Flow was $(18.0) million in the first quarter 2022 compared to $17.9 million during the prior quarter and $38.5 million during the first quarter 2021. The decrease in Free Cash Flow quarter over quarter and year over year was due primarily to lower operating cash flows. (Free Cash Flow is a non-GAAP measure. See reconciliation below.)

Financial Condition and Liquidity

Cash and cash equivalents were $229.7 million at March 31, 2022, and excluded $72.9 million of restricted cash, which primarily relates to cash pledged as collateral on a short-term project-related letter of credit. Available capacity under our ABL facility was $41.2 million at March 31, 2022. At March 31, 2022 we had $301.6 million of long-term debt and negative net debt of $1.1 million.

Conference Call Information

Further details are provided in the presentation for Helix’s quarterly teleconference to review its first quarter 2022 results (see the “For the Investor” page of Helix’s website, www.helixesg.com). The teleconference, scheduled for Tuesday, April 26, 2022, at 9:00 a.m. Central Time, will be audio webcast live from the “For the Investor” page of Helix’s website. Investors and other interested parties wishing to participate in the teleconference may join by dialing 877-243-4912 for participants in the United States and 212-231-2938 for international participants. The passcode is “Staffeldt.” A replay of the webcast will be available on the “For the Investor” page of Helix’s website by selecting the “Audio Archives” link beginning approximately two hours after the completion of the event.

For more such updates and perspectives around Digital Innovation, IoT, Data Infrastructure, AI & Cybersecurity, go to AI-Techpark.com.