Marin Software Incorporated (NASDAQ: MRIN), a leading provider of digital marketing software for performance-driven advertisers and agencies, today announced financial results for the fourth quarter and full year ended December 31, 2021.

“As advertisers look to new channels and publishers for growth, MarinOne will be there to help them maximize their digital marketing investments,” said Chris Lien, Marin Software’s Chairman and CEO, “The addition of support for LinkedIn, CitrusAd, and Amazon DSP in Q4 further expands reach for B2B and retail advertisers.”

Fourth Quarter 2021 Product Highlights:

- Added support for Amazon DSP, allowing customers to amplify their entire Amazon Advertising portfolio.

- Introduced Amazon Inventory (also known as Amazon Shopping Products) to allow users to link Amazon Seller Central accounts. This gives users a more holistic view of their ecommerce efforts, spanning both organic and sponsored listings.

- Added support for advertising on CitrusAd, a leading retail media platform.

- Expanded our social Message Booster functionality to Instagram, enabling automatic boosting of high-performance organic posts.

- Added MarinOne’s powerful forecasting features to be available at the Bid Strategy-level, in addition to the existing account-level option. This enables advertisers to forecast performance for subsets of their account.

- Rolled out ad extension management functionality to MarinOne so Sitelinks, Call Extensions, Callout Extensions, and Mobile App Extensions can now be managed in a single location.

- Redesigned our Insights feature with ease-of-use in mind, introducing shortcuts and color-coded cards so users can quickly jump to the Insights they need most.

- Introduced a new Insight, Recently Ended Campaigns, which allows users to confirm which campaigns should no longer be running and make the necessary updates.

- Introduced Activity Log alerts, which highlight when changes have been made and need to be synced with publisher accounts.

- Added several new multi-edit options, including Bid Overrides and social object status.

- Added a number of Apple Search Ads improvements, such as the ability to increase campaign budget by an amount or a percentage and the ability to use scheduled actions.

- Named an official measurement partner for LinkedIn Marketing Solutions by LinkedIn, giving advertisers better insights and improves the performance of their LinkedIn campaigns through machine learning and automation.

Fourth Quarter 2021 Financial Updates:

- Net revenues totaled $5.9 million, a year-over-year decrease of 19% when compared to $7.3 million in the fourth quarter of 2020.

- GAAP loss from operations was ($5.3) million, resulting in a GAAP operating margin of (91%), as compared to a GAAP loss from operations of ($3.1) million and a GAAP operating margin of (43%) for the fourth quarter of 2020.

- Non-GAAP loss from operations was ($3.8) million, resulting in a non-GAAP operating margin of (65%), as compared to a non-GAAP loss from operations of ($2.5) million and a non-GAAP operating margin of (34%) for the fourth quarter of 2020.

Full Year 2021 Financial Updates:

- Net revenues totaled $24.4 million, a year-over-year decrease of 19% when compared to $30.0 million in 2020.

- GAAP loss from operations was ($14.1) million, resulting in a GAAP operating margin of (58%), as compared to a GAAP loss from operations of ($16.3) million and a GAAP operating margin of (54%) for 2020.

- Non-GAAP loss from operations was ($12.0) million, resulting in a non-GAAP operating margin of (49%), as compared to a non-GAAP loss from operations of ($12.4) million and a non-GAAP operating margin of (41%) for 2020.

- Cash, cash equivalents and restricted cash were $47.1 million in the aggregate at December 31, 2021.

- Raised net proceeds of $41.7 million from issuances and sales of common stock under the Company’s “at-the-market” securities offering facilities, at a weighted average sales price of $7.85 per share.

- Entered into a new three-year revenue share agreement with Google.

In January 2022, an aggregate principal amount of $3.1 million of the loan that the Company obtained pursuant to the Paycheck Protection Program under the Coronavirus Aid, Relief, and Economic Security (CARES) Act was forgiven, and in February 2022, the Company repaid the remaining outstanding balance of the loan of $0.2 million.

Reconciliations of GAAP to non-GAAP financial measures have been provided in the financial statement tables included in this press release. An explanation of these measures is also included below, under the heading “Non-GAAP Financial Measures.”

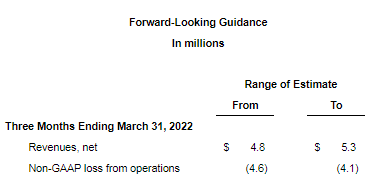

Financial Outlook:

Marin is providing guidance for its first quarter of 2022 as follows:

Non-GAAP loss from operations excludes the effects of stock-based compensation, amortization of internally developed software, impairment of long-lived assets, capitalization of internally developed software, non-recurring costs associated with restructurings, and certain professional fees that the Company has incurred in responding to third-party subpoenas that the Company has received related to governmental investigations of Google and Facebook.

Additionally, the Company does not reconcile its forward-looking non-GAAP loss from operations, due to variability between revenues and non-cash items such as stock-based compensation. The GAAP loss from operations includes stock-based compensation expense, which is affected by hiring and retention needs, as well as the future price of Marin’s stock. As a result, a reconciliation of the forward-looking non-GAAP financial measures to the corresponding GAAP measures cannot be made without unreasonable effort.

Quarterly Results Conference Call

Marin Software will host a conference call today at 2:00 PM Pacific Time (5:00 PM Eastern Time) to review the Company’s financial results for the quarter and full year ended December 31, 2021, and its outlook for the future. To access the call, please dial (877) 705-6003 in the United States or (201) 493-6725 internationally with reference to conference ID 13726540. A live webcast of the conference call will be accessible at https://themediaframe.com/mediaframe/webcast.html?webcastid=bTpebnys. Following the completion of the call through 11:59 p.m. Eastern Time on March 3, 2022, a recorded replay will be available on the Company’s website at http://investor.marinsoftware.com/ and a telephone replay will be available by dialing (844) 512-2921 in the United States or (412) 317-6671 internationally with the recording access code 13726540.

Visit AITechPark for cutting-edge Tech Trends around AI, ML, Cybersecurity, along with AITech News, and timely updates from industry professionals!