Revenue of $3.9 million up 66% over prior year, product revenue of $2.9 million up 23%

Pipeline of 924 MyoPro candidates up 14% over fourth quarter of 2021

Conference call begins at 4:30 p.m. Eastern time today

Myomo, Inc. (NYSE American: MYO) (“Myomo” or the “Company”), a wearable medical robotics company that offers increased functionality for those suffering from neurological disorders and upper-limb paralysis, today announced financial results for the three months ended March 31, 2022.

Financial and operational highlights for the first quarter of 2022 include the following (all comparisons are with the first quarter of 2021, unless otherwise noted):

- Revenue was $3.9 million and includes $1.0 million in license revenue from the Company’s China joint venture partner, up 66%

- Product revenue was $2.9 million, up 23%

- Revenue from the direct billing channel was 65% of product revenue, reflecting strong growth in international O&P sales

- International revenue represented 23% of product revenue, compared with 13%

- Revenue units were 71, up 9%

- Gross margin was 66.7%, down 670 basis points due in part to the large number of MyoPro deliveries made during the quarter that were awaiting payment for revenue recognition

- Backlog, which represents insurance authorizations and orders received but not yet converted to revenue, was 160 units, up 36%

- MyoPro® orders and insurance authorizations were received for 94 patients, up 42%

- The reimbursement pipeline as of March 31, 2022 consisted of 924 MyoPro candidates, including 358 additions during the first quarter, up 62% over the fourth quarter of 2021

Management Commentary

“First quarter product revenue was in line with our expectations, with growth reflecting a higher number of MyoPro units sold, strong results in international markets and a leveling off in ASP-related growth as the percentage of product revenue from the direct-billing channel matures,” stated Paul R. Gudonis, Myomo’s chairman and chief executive officer. “Pipeline additions grew during the quarter due to a combination of new leads from our marketing efforts and from previously interested patients who are now moving ahead to obtain a MyoPro. We continue to adapt and expand the breadth of our marketing and patient education strategies in the dynamic online environment to cost-effectively introduce the MyoPro to more candidates.

“Our joint venture in China is nearing the start-up of operations, with receipt of the initial $1.0 million license payment during the first quarter. We expect operations to launch in the second half of this year after payment of the remainder of the license fee, which is expected before the end of the second quarter. In Europe, our sales organization has been very effective in raising awareness of the MyoPro, particularly in Germany where we have been reimbursed by statutory health insurance plans that cover 52% of the population,” he added. “In support of our goal to better control our supply chain, in-house manufacturing of the MyoPro2+ began during the quarter and is proceeding well. In addition, there have been no major changes with respect to reimbursement from our largest payer, where we continue to receive new authorizations and payment after filing post-delivery appeals. We further diversified our payer base with first-time authorizations during the quarter from several Medicare Advantage programs and state Blue Cross Blue Shield plans.”

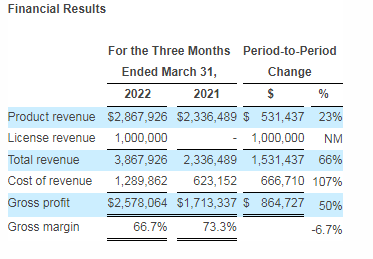

Revenue for the first quarter of 2022 was $3.9 million, an increase of 66% compared with the first quarter of 2021. First quarter revenue included $1.0 million of license revenue from the Company’s joint venture partner in China. Product revenue for the first quarter of 2022 was $2.9 million, an increase of 23% compared with the first quarter of 2021. Growth in product revenue was driven by a higher number of revenue units and a higher average selling price. Myomo recognized revenue on 71 units in the first quarter of 2022, an increase of 9% compared with the fourth quarter of 2021.

Gross margin for the first quarter of 2022 was 66.7%. Gross margin on product revenue was 55.0%, compared with 73.3% for the first quarter of 2021. The decrease reflected a larger number of deliveries, which is when the Company records cost of goods sold, compared with the number of revenue units. Deliveries increased during the quarter as the Company successfully completed its transition to in-house fabrication of the MyoPro2+. In addition, gross margin was affected by one-time costs associated with the termination of the contract with the Company’s third-party fabrication partner and higher material costs.

Operating expenses for the first quarter of 2022 were $5.3 million, an increase of 14% compared with the first quarter of 2021. The increase was driven primarily by higher payroll and advertising costs.

Operating loss for the first quarter of 2022 decreased to $2.7 million from $2.9 million for the first quarter of 2021. Net loss for the first quarter of 2022 was $2.8 million, or $0.41 per share, compared with net loss of $3.0 million, or $0.57 per share, for the first quarter of 2021.

Adjusted EBITDA1 for the first quarter of 2022 was negative $2.4 million, compared with negative $2.7 million for the first quarter of 2021. A reconciliation of GAAP net loss to this non-GAAP financial measure appears below.

Liquidity

Cash and cash equivalents as of March 31, 2022 were $12.9 million. Cash used in operating activities was $2.3 million for the first quarter of 2022. The Company continues to believe its existing cash is sufficient to fund operations for at least the next 12 months.

Business Outlook

“As the growing pipeline of MyoPro candidates converts into orders, we continue to expect year-over-year product revenue growth in 2022. Assuming receipt of the final payment of the license fee from our joint venture partner in China, $1.7 million of license revenue is expected to be recorded in the second quarter. Second quarter product revenues will reflect how much of the roughly $6.0 million of potential revenue in backlog we are able to recognize, along with our ability to generate new fill orders from the O&P, VA and international channels. We are diligently working to grow the pipeline while deploying creative ways to adapt to a changing marketing environment,” said Gudonis.

Conference Call and Webcast Information

Myomo will hold a conference call today at 4:30 p.m. Eastern time to discuss these results and answer questions. Participants are encouraged to pre-register for the call here. Callers who pre-register will be given a conference passcode and unique PIN to gain immediate access to the call and bypass the live operator. Participants may pre-register at any time including up to and after the start of the call. Those unable to pre-register may participate by dialing 844-707-6932 (U.S.) or 412-317-9250 (International). A webcast of the call will also be available at Myomo’s Investor Relations page at http://ir.myomo.com/.

A replay of the webcast will be available beginning approximately one hour after the completion of the live conference call at http://ir.myomo.com/. A dial-in replay of the call will be available until May 25, 2022; please dial 877-344-7529 (U.S.) or 412-317-0088 (International) and provide the passcode 6293427.

Non-GAAP Financial Measures

Myomo is providing financial information that has not been prepared in accordance with generally accepted accounting principles in the United States, or GAAP. This information includes Adjusted EBITDA. This non-GAAP financial measure is not in accordance with, or an alternative for, GAAP and may be different from similar non-GAAP financial measures used by other companies. Myomo believes the use of this non-GAAP financial measure provides supplementary information for investors to use in evaluating operating performance and in comparing Myomo’s financial measures with other companies in its industry, many of which present similar non-GAAP financial measures. Adjusted EBITDA is EBITDA adjusted for stock-based compensation expense. This non-GAAP financial measure is not meant to be considered superior to or a substitute for results of operations prepared in accordance with GAAP, and should be viewed in conjunction with GAAP financial measures. Investors are encouraged to review the reconciliation of this non-GAAP measure to its most directly comparable GAAP financial measure. A reconciliation of GAAP to the non-GAAP financial measures has been provided in the tables included as part of this press release.

Visit AITechPark for cutting-edge Tech Trends around AI, ML, Cybersecurity, along with AITech News, and timely updates from industry professionals!