A solid performance driven by the Group’s transformation to a SaaS model

Consolidated 2021 revenues of $88.5 M (IFRS)

- Growth in recurring subscription-related revenues1 over 1 year: +11% (+26% in Q4 compared to Q4 2020)

- Strong growth of subscription and SaaS Annual Recuring Revenue (ARR)2: +43.1%

- Recurring revenues now representing 35% of total software business

- $71.8 million corresponding to software revenues and $16.6 million to proceeds from the sale of the NFC patents

- Sales volumes down 7% compared with fiscal year 2020 ($94.9 M)

Consolidated 2021 EBITDA3 at $19M corresponding to 21.5% of revenues

- Excluding the NFC patent licensing program, EBITDA for the software business is $5.5 million, or 7.6% of revenues.

- In the second half of 2021, EBITDA of the software business increased by over $6M.

Net income of $3.7 M (IFRS) versus a loss of $1.4 M in 2020 (+$5.1 M)

$45.3 M in available cash at 31/12/2021 to accelerate the Group’s transformation

- $45.3 M in cash and cash equivalents compared to $48.6 M as of December 31, 2020

- Reduction of gross debt by $15 M in the course of 2021

- Net debt amounting to $0.7 M

The Group’s ambition and the details of the strategic plan are specified in a dedicated press release which will be issued today at 6 pm. A full presentation will be shared with professional investors on Thursday, March 10, starting at 9:30 a.m. and will be accessible to all via the Verimatrix website at the following address

Verimatrix (Paris:VMX) (Euronext Paris: VMX), today reported its unaudited consolidated IFRS results4 and its unaudited adjusted results for the year ended December 31, 2021.

Commenting on these results, Amedeo D’Angelo, chairman and chief executive officer of Verimatrix, stated: “I am pleased that we met our revenue objective from the software business in Q4. We have accelerated our transformation becoming a key provider of Cloud-Based security solution and increasing our subscription revenue. The overall 2021 has been a difficult year due to the Covid Pandemic and the decision to transform the business model from Perpetual License to Subscription and SaaS. These decisions have increased the complexity of running our business, forcing us to start a deep organizational transformation adding the C.O.O. position with Asaf Ashkenazi and a new CFO with extended SaaS experience. In December 2021 we have announced our new Anti-Piracy solutions StreamKeeper to answer to the growing content protection needs for streaming media, mobile use and OTT entertainment. Our new Verimatrix Platform is ready and will become the entry point for all our customers to have access to our portfolio of Cloud Based solutions.”

1. Financial Results – Key figures

2021 Income statement – key figures

| (in thousands of US$) | 2021 | 2020 |

| Revenue | 88 465 | 94 893 |

| EBITDA | 19 016 | 24 000 |

| Revenue software business | 71 820 | 94 893 |

| EBITDA software business | 5 462 | 24 000 |

| Consolidated revenue (IFRS) | 88 465 | 94 893 |

| Operating income (IFRS) | 8 029 | 11 778 |

| Net income from continuing operations (IFRS) | 3 673 | (1 356) |

In Q4 2021, business volume in line with the Group’s transformation strategy

During the quarter, the Group continued to deploy its strategy focused on subscription and SaaS sales. Verimatrix’s total revenue for the quarter amounted to $20.6 million, down 16% compared to 2020, in line with the Group’s expectations and its ambition to develop its Subscription and SaaS business model.

As expected, non-recurring revenues from licenses, royalties and professional services amounted to $14.1 million, down 16% year-on-year. This is a combination of the effects of reallocation of sales resources to subscription-based sales, royalties still affected by the semiconductor shortage and the continued impact of the Covid-19 crisis on customer investment levels.

Above all, the fourth quarter was characterized by:

– The 26% increase in subscription revenue compared to the same quarter of 2020

– A 15.7% increase in Subscription and SaaS ARR compared to Q3 2021, to $7.5M

– The stabilization of maintenance revenue at $5M since Q2 2021

– Total ARR, including maintenance, is $26.8M as of 31/12/2021

For the full year 2021, recurring revenues of the software business represents 35% of sales

Revenues for 2021 amounted to $88.5 M, compared with $94.9 M in 2020, representing a 7% year-on-year decline. Excluding non-recurring revenues from sales based on NFC products, divested in December 2021, and corresponding to $16.6 M, Group revenues for the core software business decreased by 24% year-on-year.

In line with the Group’s expectations and its ambition to move towards a SaaS model, recurring revenues from SaaS and subscription amounted to $5.6 M for the full year 2021, up 11% compared to 2020.

NFC patent licensing program

In 2021, France Brevets, Verimatrix’s NFC patent licensing partner, signed four licensing agreements with major OEMs that generated $16.6 M in revenue for Verimatrix. In December 2021, Verimatrix sold its historical NFC patent portfolio to semiconductor company Infineon Technologies AG for nearly $2 M, ending the participation of Verimatrix’ patents in the NFC patent licensing program.

Gross margin of 75.4% of adjusted sales

The gross margin for 2021 is $66.7 M, compared with $78.1 M for 2020. This decrease in gross margin is due to the nature of the business mix including the NFC licensing program, which generates a margin of around 71%, and a lower absorption of fixed costs. Excluding the contribution of the NFC licensing program from the 2020 gross margin, the gross margin would be 76.4% of revenues, compared to a 2021 gross margin of 75.4% of revenues.

Adjusted operating expenses down sharply

Operating expenses decreased in 2021 to $51.8 M from $58.4 M a year earlier. This change reflects :

- Lower expenses concomitant with lower perpetual license sales

- Higher capitalization of research and development expenses ($1.5 M). The company has focused its resources on the development of the new cloud-based platform and its new anti-piracy solutions for streaming, including “Streamkeeper”.

- Maintaining strict control of expenses in the uncertain global context

- An unfavorable parity of the euro against the U.S. dollar, weighing on operating expenses and profits for approximately $1.1 M.

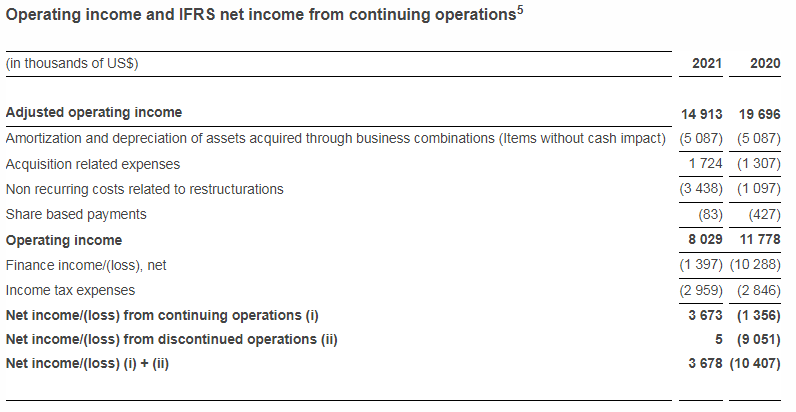

Adjusted operating income and EBITDA

The 2021 adjusted operating profit is $14.9 M, compared to $19.7 M achieved in 2020. Excluding the contribution of the NFC licensing program, which generated $13.0 M of operating profit in 2021, adjusted operating profit was $1.9 M.

EBITDA for the full year reached $19 M, or 21.5% of revenue, compared to $24 M in 2020 and 25.3% of revenue. Excluding the contribution of the NFC patent licensing program, which generated $13.6 M in EBITDA in 2021, EBITDA remained positive at $5.4 M.

In 2021, the company generated operating income of $8 M compared to $11.8 M realized in 2020, characterized by:

- The termination in April 2021 of a lease agreement for a building that has been vacant since September 2019 in San Diego; as a result, the company reversed a provision in the amount of $2.5 M corresponding to rent savings and associated costs over the next 4 years.

- The signature in June 2021 of a settlement agreement with the selling shareholders of Verimatrix, Inc. regarding the final purchase price of Verimatrix, Inc. In this context, Verimatrix received an amount of $8.8 M in cash, significantly higher than the expected amount of $6.9 M, which led to the recording of a non-recurring profit in the results of $1.9 M.

- The Group’s decision in September 2021 to write down 45% of its U.S. headquarters based in San Diego (CA), for $4.5 M, following the reduction of workspace.

Financial loss amounted to $1.4 M in 2021, mainly due to interest paid in relation to debt for $4.0 M (bullet loan bill maturing in 2026, convertible bonds maturing in June 2022 and lease commitments under IFRS16) as well as net foreign exchange loss and non-cash charges (positive impact of the change in fair value of convertible bonds for $3.2 M).

In 2021, the Group generated a consolidated net income of $3.7 M compared to a net loss of $11.4 M in 2020. This corresponds to the sum of operating income from continuing operations ($8 M), net financial expenses ($1.4 M) and income tax ($3.0 M).

4. Financial position and cash flows

Net debt amounts to $0.7 M as of December 31, 2021, compared to $11.5 M as of December 31, 2020.

Net debt comprises cash, cash equivalents and short-term investments, less bank overdrafts, financial debt (excluding obligations under IFRS 16 for finance leases), bank loans, private loans (Apera debt maturing in 2026) and the debt component of the “OCEANE” convertible bonds maturing in 2022 (see reconciliation with IFRS in Appendix 2 of this document)

On December 31, 2021, the Group’s consolidated cash position was $45.3 M compared with $48.6 M on December 31, 2020, marked by the partial early repayment of the $15 M unitranche bullet loan in March 2021.

Cash flow

Operating activities generated $26.9 M of cash flow in 2021, compared to $12.6 M in 2020.

Interest expense used $4 M of cash in 2021, compared to $5.7 M in 2020, due to the impact of the partial repayment of the unitranche loan bill combined with a lower interest rate in accordance with the loan bill agreement.

Investing activities used $8.3 M, including capitalized R&D for $5.9 million and IT infrastructure and application projects for $1.8 M.

Financing activities used $16.7 M of cash in 2021, primarily due to the partial prepayment of the unitranche bond for $15 M in March 2021.

For more such updates and perspectives around Digital Innovation, IoT, Data Infrastructure, AI & Cybersecurity, go to AI-Techpark.com.