Fourth quarter revenue growth accelerates to 30% year-over-year on an FX Neutral basis

VTEX (NYSE:VTEX), the enterprise digital commerce platform for premier brands and retailers, the leader in accelerating the digital commerce transformation in Latin America and now expanding globally, today announced results for the fourth quarter of 2021 ended December 31, 2021. VTEX results have been prepared in accordance with International Financial Reporting Standards (“IFRS)” and interpretations issued by the IFRS Interpretations Committee (“IFRS IC”) applicable to companies reporting under IFRS.

Geraldo Thomaz Jr., founder and co-CEO of VTEX, commented, “We are excited to announce VTEX’s strong performance in our last quarter of 2021. We continued seeing strong execution and accelerated product development, giving us confidence in the future growth of the company.” Mariano Gomide de Faria, founder and co-CEO of VTEX, added, “VTEX is better positioned than ever to reach its desirable future. The investments we’ve made in 2021 will enable us to continue growing at an accelerated pace while delivering significant operational leverage in 2022. We are thrilled to share with you the solid steps we are making in our journey to bring enterprises and brands closer to consumers.”

Fourth quarter 2021 Operational and Financial Highlights

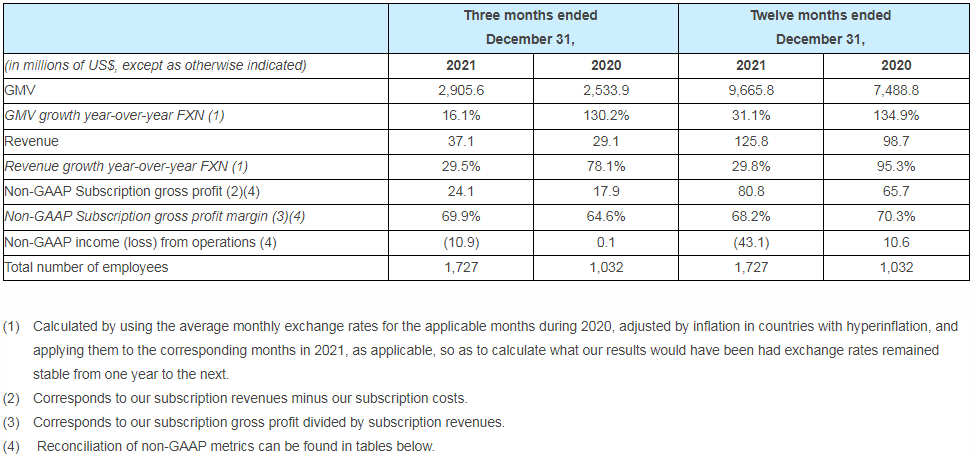

- GMV reached US$2.9 billion in the fourth quarter of 2021, representing a year-over-year increase of 14.7% in USD and 16.1% on an FX neutral basis.

- Total revenues increased to US$37.1 million in the fourth quarter of 2021, from US$29.1 million in the fourth quarter of 2020, representing a year-over-year increase of 27.5% in USD and 29.5% on an FX neutral basis.

- Subscription revenue represented 93.0% of total revenues and increased to US$34.5 million in the fourth quarter of 2021, from US$27.7 million in the fourth quarter of 2020, a year-over-year increase of 24.8% in USD and 26.4% on an FX neutral basis.

- Non-GAAP subscription gross profit was US$24.1 million in the fourth quarter of 2021, compared to US$17.9 million in the fourth quarter of 2020, representing a year-over-year increase of 35.0% in USD and 38.2% on an FX neutral basis.

- Non-GAAP subscription gross margin was 69.9% in the fourth quarter of 2021, compared to 64.6% in the same quarter of 2020. Non-GAAP subscription gross profit margin year-over-year improvement reflects operational hosting cost efficiencies.

- Non-GAAP loss from operations was US$10.9 million during the fourth quarter of 2021, compared to Non-GAAP income from operations of US$0.1 million in the fourth quarter of 2020, primarily due to incremental personnel-related investments in sales and marketing, and research and development, as we have been investing to capture market share and benefit from the further penetration of ecommerce.

- Non-GAAP negative free cash flow was US$21.3 million during the fourth quarter of 2021, compared to a positive US$2.4 million free cash flow in the fourth quarter of 2020, mainly driven by the increase in Non-GAAP loss from operations.

- Our total headcount increased to 1,727 as of December 31, 2021, representing an increase of 67.3% year-over-year and 6.3% quarter-over-quarter.

Fourth quarter Product Innovation Highlights:

Key innovations deployed this quarter:

- Zero friction onboarding and collaboration:

- Continued making progress with our new front-end framework called FastStore, where we currently have live large enterprise customers such as Carrefour. We have already successfully mentored SIs that are now implementing this new module for VTEX IO that was built from scratch with storefront performance in mind without compromising flexibility or development productivity.

- Enabled companies such as Doto, MontenBaik, Elefant, GM Heritage and Samsung to broaden their third-party assortment through our sellers onboarding portal.

- Seeking to enhance the consumer’s journey, in such a consumer-driven environment, we enabled shoppers to navigate in our customers’ website and check for the local availability of each product, relying on faster delivery SLA if the product is available in a nearby physical store or franchisee. We already have Carrefour, Emporio da Cerveja and C&A among others benefiting from this new capability.

- Continued making strides related to our inStore’s endless aisle approach. Now physical store’s sales associates can use filters such as price range, department, and brand, among other configurable filters, when searching for products on inStore VTEX Intelligent Search. This results in a more dynamic and precise process, speeding up sales, allowing them to quickly find the desired product.

- Single control panel for every order:

- Live Shopping App is now available for our customers. Our native live stream app helps brands and retailers using VTEX Commerce Platform to create one-to-many or one-to-one immersive live shopping experiences, increasing engagement and conversion rates, unlocking new growth opportunities by simplifying how to start, plan, manage and track performance of live shopping events.

- Increased the support for our customers who want to introduce sales capabilities to their conversational touch points. Several customers at VTEX already combine the worlds of commerce and conversational platforms. We are onboarding customers from different segments, such as grocery and drug stores, to enable them to sell through Whatsapp and other conversational interfaces, a significant emerging channel that will complement physical stores, browsers, mobile apps, marketplaces and other sales channels. We also launched VTEX Tracking notifications via WhatsApp, in addition to SMS and email notifications, increasing reviews response rate.

- Launched social commerce, which enables sales associates in the physical store of our customers to share products via QR codes, using the social selling feature in-store.

- Commerce on auto-pilot and co-pilot:

- Launched the new VTEX Log performance panel, where customers can have a graphical presentation and description of each carrier’s performance with algorithms suggesting which one is more efficient for each particular delivery. Now our customers can track carrier’s performance calculation results and leverage all the detailed information we have on each carrier for specific routes.

- The development platform of choice for digital commerce:

- Continued attracting developers to our low-code platform, gaining momentum in the community and scaling our capabilities. Monthly active developers accessing the VTEX development portal increased to more than 20 thousand in Q4 from more than 14 thousand in Q3. Additionally, we are excited to announce that this quarter US developers accessing our portal have more than doubled quarter-over-quarter.

Full-Year 2021 Operational and Financial Highlights

- GMV reached US$9.7 billion in 2021, representing a year-over-year increase of 29.1% in USD and 31.1% on an FX neutral basis.

- Number of customers totaled more than 2.4 thousand in 2021, representing a year-over-year increase of 20%.

- Number of stores totaled more than 3.2 thousand in 2021, a year-over-year increase of 25.3%, in 38 countries, adding 6 countries this year. Our top 100 customers have an average of 4.8 stores per customer, up from 3.7 in 2020. Active stores with more than US$25 thousand Annual Recurring Revenue (“ARR”) represented 81.7% of our revenue and reached an average ARR per store of US$128.6 thousand.

- Total revenues increased to US$125.8 million in 2021, from US$98.7 million in 2020, representing a year-over-year increase of 27.5% in USD and 29.8% on an FX neutral basis.

- In 2021, our same-store-sales (“SSS”) were up 11.8% on a FX Neutral basis, on top of 2020 SSS growth of 89.9%.

- Revenue from existing stores increased to US$87.3 million in 2021. The net revenue retention rate (“NRR”) on a FX neutral basis was 105.1% in 2021, impacted by physical stores reopening, on top of a NRR of 171.9% in the fiscal year 2020, benefitted by physical stores temporarily closing.

- Revenues from new stores increased to US$19.4 million in 2021 compared to US$12.1 million in the fiscal year 2020.

- In 2021, Brazil revenues increased by 24.4%, Latin America excluding Brazil by 27.6%, and Rest of the World by 97.5% on a year-over-year FX neutral basis, and 46%, 84% and 96%, respectively, on a 2-year CAGR. In 2021, Brazil, Latin America excluding Brazil and Rest of the World represented 53%, 38% and 9% of our total revenue respectively, compared to 57%, 37% and 6% respectively in 2020.

- Subscription revenue represented 94.2% of total revenues and increased to US$118.5 million in 2021, from US$93.4 million in 2020, a year-over-year increase of 26.9% in USD and 29.2% on an FX neutral basis.

- In 2021, R&D represented 34% of total employees, increasing 57.9% year-over-year, S&M represented 32% of total employees, increasing 111.1% year-over-year, G&A represented 14% of total employees, increasing 27.6% year-over-year, and under COGS we have our customer success teams which represented 20% of total employees, increasing 66.0% year-over-year.

Business Outlook

Online commerce penetration in Latin America continues to increase, demonstrating that consumer behavior shift towards online purchases has staying power.

We expect strong new stores’ growth, as our encouraging backlog undergoes implementation, as well as a strong performance of existing stores compared to last year, as we have already mostly lapped the impact of COVID-19.

In view of the aforementioned trends, we are currently targeting revenue in the US$33.0 million to US$33.5 million range for the first quarter of 2022, implying a 30% year-over-year FX neutral growth rate in the middle of the range.

For the full year 2022, we expect FX neutral year-over-year revenue growth of 29% to 31%, implying a range of US$158 million to US$162 million as of the end of the fourth quarter FX rates.

We will continue to invest to grow our business as we work towards enhancing our leadership position in Latin America and explore new opportunities outside the region. Considering that over the last 18 months we tripled our investments and opened attractive growth avenues for VTEX, in 2022 we will benefit from the aforementioned investment by growing at a strong pace while at the same time delivering significant operating margin expansion.

The business outlook provided above constitutes forward-looking information within the meaning of applicable securities laws and is based on a number of assumptions and subject to a number of risks. Actual results could vary materially as a result of numerous factors, including certain risk factors, many of which are beyond VTEX’s control. See the cautionary note regarding ”Forward-Looking Statements” below. Fluctuations in VTEX’s operating results may be particularly pronounced in the current economic environment. There can not be assurance that VTEX will achieve these results.

The following table summarizes certain key financial and operating metrics for the three and twelve months ended December 31, 2021 and 2020.

Conference Call and Webcast

The conference call may be accessed by dialing +1-844-200-6205 (Conference ID – 851266 –) and requesting inclusion in the call for VTEX.

The live conference call can be accessed via audio webcast at the investor relations section of the Company’s website, at https://www.investors.vtex.com/.

An archive of the webcast will be available for one week following the conclusion of the conference call.

Definition of Selected Operational Metrics

“ARR” means annual recurring revenue, calculated as subscription revenue in the most recent quarter multiplied by four.

“Customers” means companies ranging from small and medium-sized businesses to larger enterprises that pay to use the VTEX Platform.

“GMV” or “Gross Merchandise Value” means total value of customer orders processed through the VTEX Platform, including value-added taxes and shipping. Our GMV does not include the value of orders processed by our SMB Platform (Loja Integrada) or B2B transactions.

“FX Neutral” or “FXN” means a way of using the average monthly exchange rates for each month during the previous year, adjusted by inflation in countries with hyper-inflation, and applying them to the corresponding months of the current year, so as to calculate what results would have been had exchange rates remained stable from one year to the next.

“NRR” means net revenue retention, calculated on a monthly basis by dividing the subscription revenue from our platform during the current period by the subscription revenue in the same period of the previous year for the same base of online stores that were active in the same period of the previous year.

“SSS” means same-store-sales calculated on a yearly basis by dividing the GMV of active online stores in the current period by the GMV of the same active online same stores in the prior period.

“Stores” or “Active Stores” means the number of unique domains generating gross merchandise value operating on the VTEX Platform. Each customer might have multiple stores. It does not include the stores operating on our SMB Platform (Loja Integrada).

Special Note Regarding Non-GAAP financial metrics

For the convenience of investors, this document presents certain Non-GAAP financial measures, which are not recognized under IFRS, specifically Non-GAAP subscription gross profit, Non-GAAP expenses, Non-GAAP income (loss) from operations, Non-GAAP free cash flow and FX neutral measures.

We understand that Non-GAAP subscription gross profit, Non-GAAP expenses, Non-GAAP Income (Loss) from Operations, Non-GAAP Free Cash Flow and FX Neutral measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results of operations presented in accordance with IFRS. Additionally, our calculations of Non-GAAP subscription gross profit, Non-GAAP expenses, Non-GAAP income (loss) from operations, Non-GAAP free cash flow and FX neutral measures may be different from the calculation used by other companies, including our competitors, and therefore, our measures may not be comparable to those of other companies.

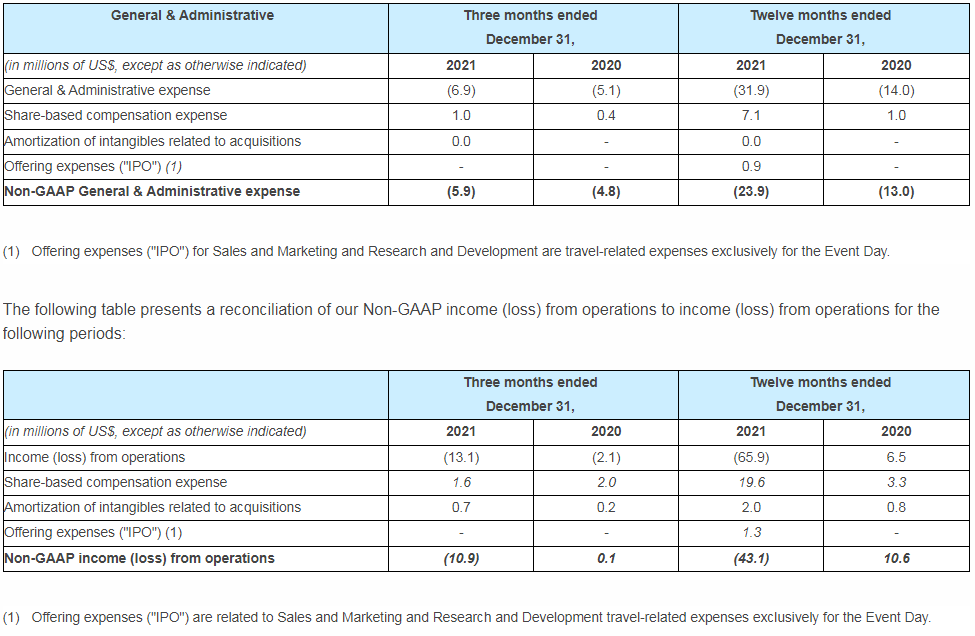

Reconciliation of Non-GAAP measures

The following table presents a reconciliation of our Non-GAAP subscription gross profit to subscription gross profit for the following periods:

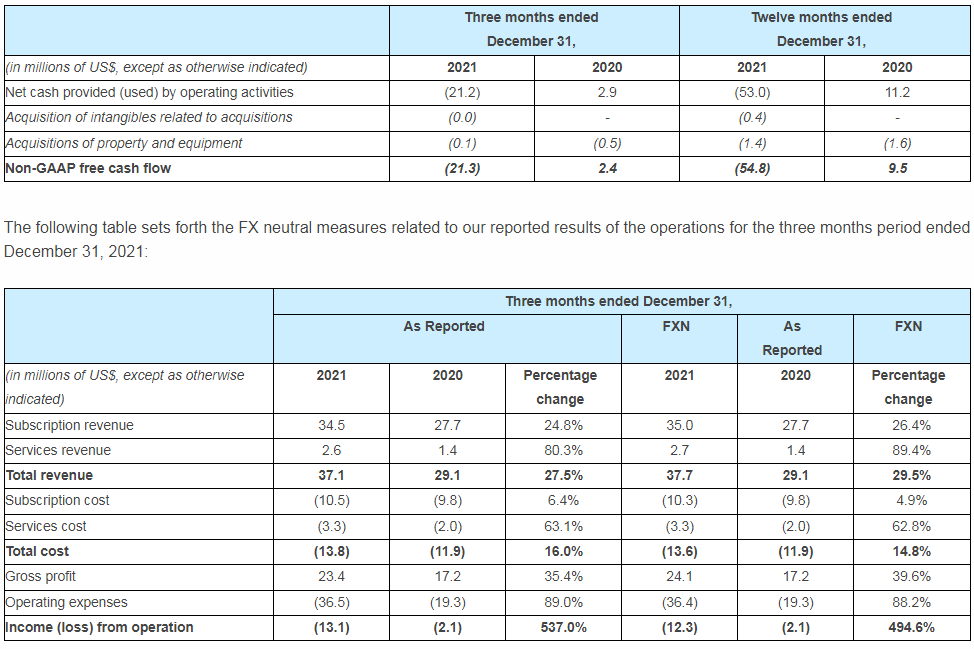

The following table presents a reconciliation of our Non-GAAP free cash flow to net cash provided (used) by operating activities for the following periods:

This announcement does not contain sufficient information to constitute an interim financial report as defined in International Accounting Standards 34, “Interim Financial Reporting” nor a financial statement as defined by International Accounting Standards 1 “Presentation of Financial Statements”. The financial information in this press release has not been audited.

Visit AITechPark for cutting-edge Tech Trends around AI, ML, Cybersecurity, along with AITech News, and timely updates from industry professionals!