TrackX Holdings Inc. (TSX.V:TKX | FRANKFURT:3TH) (“TrackX” or the “Company), a Software-as-a-Service (SaaS)-based enterprise asset management solution provider, announces the financial and operational highlights from its third quarter ended June 30, 2022 (“Q3 2022”). All results are reported in Canadian dollars unless otherwise specified. A complete set of the Q3 2022 Consolidated Financial Statements and Management’s Discussion & Analysis has been filed on SEDAR (www.sedar.com).

In Q3 2022, TrackX continued to expand its enterprise scalable, IoT-enabled technology platform in response to demand by companies seeking improved supply chain tracing, tracking, execution and sustainability solutions. Companies across multiple industries and around the globe are needing to invest in technologies in order to remain competitive in today’s global supply chain environment:

- Consumers want detailed information about the products they are purchasing and are insisting that companies they purchase from provide proof of environment, social and governance (ESG) initiatives and practices. They want to make sure that manufacturers are acting responsibly and have sustainability initiatives in place to protect the environment.

- Regulatory compliance and industry mandates are requiring companies to comply or face significant penalties. The TrackX solution platform is helping companies to comply with the ever growing increase in regulatory mandates and legal requirements.

- In this post pandemic era, companies in every industry are seeking improved visibility, transparency and collaboration across all supply chain partners. In Q3 2022, TrackX continued to enhance its technology platform to further support digital transformation efforts and increased operational efficiency.

- Supply chain management solutions are imperative to helping customers speed information flow, to safely and securely share data with their entire supply chain ecosystem and to leverage their assets and labor much more effectively. TrackX possesses decades of supply chain and process automation experience to help companies operate more efficiently with less labor expense.

In Q3 2022, while there was an increase in new pipeline activity, new customer engagements lagged behind expansion opportunities within existing accounts. This was largely due to a reduction in sales and implementation resources as well as an increase in requests from existing customers for additional customizations. For Do Good Foods, after a successful implementation at their first processing facility, TrackX is now working on solution enhancements for additional processing facilities. For one of the largest global powersports leaders, TrackX is continuing to make numerous enhancements to improve its vehicle inventory management solution. With a large US Fortune 500 Insurance Company, TrackX is supporting the customer’s enhancement request for improved asset tracking capabilities across multiple data centers. For a growing supply chain solutions partner in Agriculture, Healthcare and Pharmaceutical, TrackX has been engaged to develop multiple customizations to its supply chain platform and mobile solutions to further support consumer visibility proof of product origin, chain of custody and ESG claims.

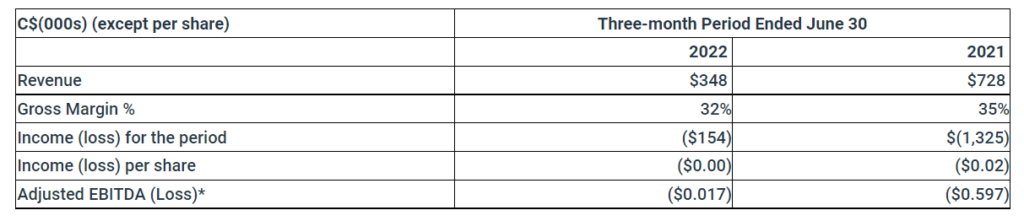

Financial Highlights for the three months ended June 30, 2022 (“Q3 2022”)

- Q3 2022 net loss improved at $0.154 million or $(0.00)/share compared to a net loss of $1.325 million or $0.02/share for Q3 2021;

- Adjusted EBITDA improved with a loss for Q3 2022 of $0.017 million compared to a $0.328 million loss for Q3 2021;

- Revenue for Q3 2022 of $0.348 million vs $0.728 million for the three months ended June 30, 2021 (“Q3 2021”). This decline is largely attributable to the decrease in perpetual software license fees from $0.379 million for Q3 2021 to $Nil Q3 2022;

- Q3 2022 gross margin of 32%, as compared to 35% in Q2 2021 largely due to a decline in high margin revenue associated with the billable transition services previously provided to FourKites;

- Recurring revenue of $0.113 million, a 26% decrease over $0.153 million for Q3 2021, largely due to contract renegotiation with a large insurance company.

Annual Revenue Mix

Selected Financial Information

Business Outlook

TrackX will continue its focus on delivering highly configurable, scalable, partner friendly SaaS-based solutions that improve clients’ supply chain processes and drive operational efficiencies. Its solution platform remains one of the only full-cycle supply chain execution platforms with the ability to scale and cater to a global market and enterprise accounts in the areas of tracing, tracking and sustainability. The Company’s SaaS-based solution platform helps support digital transformation efforts and enables product visibility across all supply chain partners from origin, through manufacturing, all the way to retail and finally to the consumer. Manufacturers are able to prove their sustainability initiatives, comply with increased regulatory mandates and protect their brands. Through TrackX Mobile, consumers are now able to gain valuable information about products they are purchasing and confidence in the validity of ESG claims.

Like many other companies, TrackX has also been impacted by COVID-19. The company has experienced ongoing implementation delays at customer sites which have negatively impacted revenue. TrackX has been forced to reduce operating expense and personnel as result. It has had to focus more energy on strengthening relationships with strategic reseller, solution and implementation partners. As these relationships grow, the Company anticipates that it will be able to announce more engagements with new clients.

Visit AITechPark for cutting-edge Tech Trends around AI, ML, Cybersecurity, along with AITech News, and timely updates from industry professionals!