Revionics report shows consumers are shopping smarter this holiday season and retailers must price accordingly to maximize sales

Revionics LLC, an Aptos company, a provider of retail pricing, promotions, markdowns, competitive insights and advanced analytics solutions, today announced findings of its Holiday Report: 2020 Pricing and Shopping Trends based on a survey of 1,041 U.S. consumers. The survey illuminates holiday consumer behaviors and pricing trends to help retailers prepare their pricing, promotion and markdown strategies for a successful season.

According to the survey, 70% of the respondents will actively seek promotions and coupons when shopping for holidays, and 45% said that discounts will be one of the most important factors in deciding where to shop. To meet these consumer expectations and drive sales, retailers must offer the right promo mix and strengthen their pricing strategy this holiday season.

Make the holidays as usual as possible

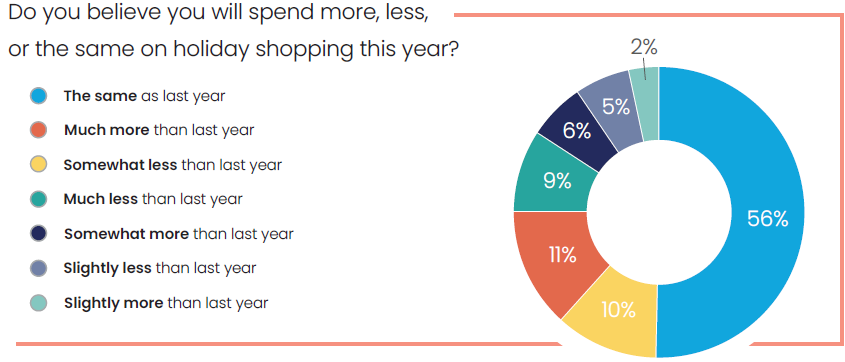

After an unprecedented year of pandemic and economic uncertainty, consumers are largely anticipating and desiring a sense of normalcy this holiday season. The survey found that 56% of respondents plan to spend the same amount of money holiday shopping this year as last, despite 29% of respondents saying their personal finances have decreased since the beginning of COVID-19.

Over half of consumers said that compared to last year, they would spend the same amount of time looking for better deals, the same amount of money on their Thanksgiving meals, and the same amount of money holiday shopping online versus in person.

“We’re glad to find that despite the many setbacks and unpredictable sales trends for retailers this year, the holidays are looking hopeful, as consumers strive for festivities not all that different from the past,” said Steve Leven, COO, Revionics, an Aptos Company. “Consumers aren’t going to let the pandemic affect their typical holiday experience, and retailers have a big opportunity to make this possible by meeting their expectations.”

Price smarter and start promos earlier

With more time and less money, consumers are shopping smarter and earlier for the holidays by looking for the best prices, expecting more promotions and extending the shopping season.

- 77% of survey respondents said pricing was a top consideration when choosing where to do their holiday shopping.

- 74% of respondents say they plan to compare prices while shopping online, and 69% plan to compare prices while shopping in person.

- 45% of consumers have more free time to shop this year, and 35% say they will use that extra time look for better deals and discounts.

- 46% of shoppers plan to start their holiday shopping before the weekend of Black Friday and Cyber Monday.

“Pricing will be key this holiday season as consumers search for the best prices during this extended holiday season,” said Leven. “To stay ahead of competitors and drive sales, retailers will need to determine the most effective promotional strategy across every channel, both online and in store. They must also start promotions and markdowns now while demand is up, keeping up with competitor price changes and evolving market trends to win over consumers. With the right data and strategy, retailers can look forward to closing out the year with strong sales and margins.”

Focus on pricing across retail channels

While consumers largely anticipate spending roughly the same amount this holiday season as last, 30% of respondents said they plan to spend more money online than last year. Contactless delivery and pickup will also remain important through the holiday season. Sixty-three percent of shoppers plan to utilize buy online pickup in store or curbside services, and 40% of consumers said that access to those services are top considerations in choosing where to do their holiday shopping.

At the same time, in-store holiday shopping is not dead. The number of respondents who shopped Black Friday sales in person last year compared to the number who plan to this year has barely changed. In regard to the entire holiday shopping season, 56% of survey respondents said they still plan to shop in store this year, and only 14% of consumers said they will not do any kind of in-person holiday shopping.

To provide the multi-channel shopping experience customers want, retailers must have a strong pricing strategy both online and in store. They must also understand which offers will perform better on different channels. For retailers to successfully nail this multi-channel strategy, they can dig into the data of past promotions and use predictive analytics to consider the evolving trends from COVID-19, confidently forecasting consumer demand this holiday season.

For more survey results and to learn how retailers can align holiday pricing strategies with shoppers’ expectations, download the Holiday Report: 2020 Pricing and Shopping Trends.

Research Methodology

The results in this report are from an online omnibus survey conducted by Researchscape International and commissioned by Revionics, an Aptos Company. The survey was fielded from September 24 to 28, 2020; 1,041 U.S. consumers completed the survey. Respondents were recruited from a number of third-party panels. Each respondent had their identity validated and only one response was permitted per respondent, even if they were members of multiple panels.

Revionics’ advanced AI models provide top retailers across a variety of industries and markets, delivers ROI, profit lift, process efficiencies and more. Their machine learning capabilities translate consumer, competitor and market data into actionable insights and transparent pricing recommendations for high-impact results.